Investment Tax Credit

The Investment Tax Credit (ITC) is a federal tax incentive designed to encourage the installation of renewable energy systems, particularly solar energy systems, in the United States. Commercial and tax-exempt buildings can qualify for the ITC by installing eligible renewable energy systems, such as solar PV systems, and meet specific criteria related to the project’s commencement, installation, ownership, and documentation.

Benefits of ITC Solution

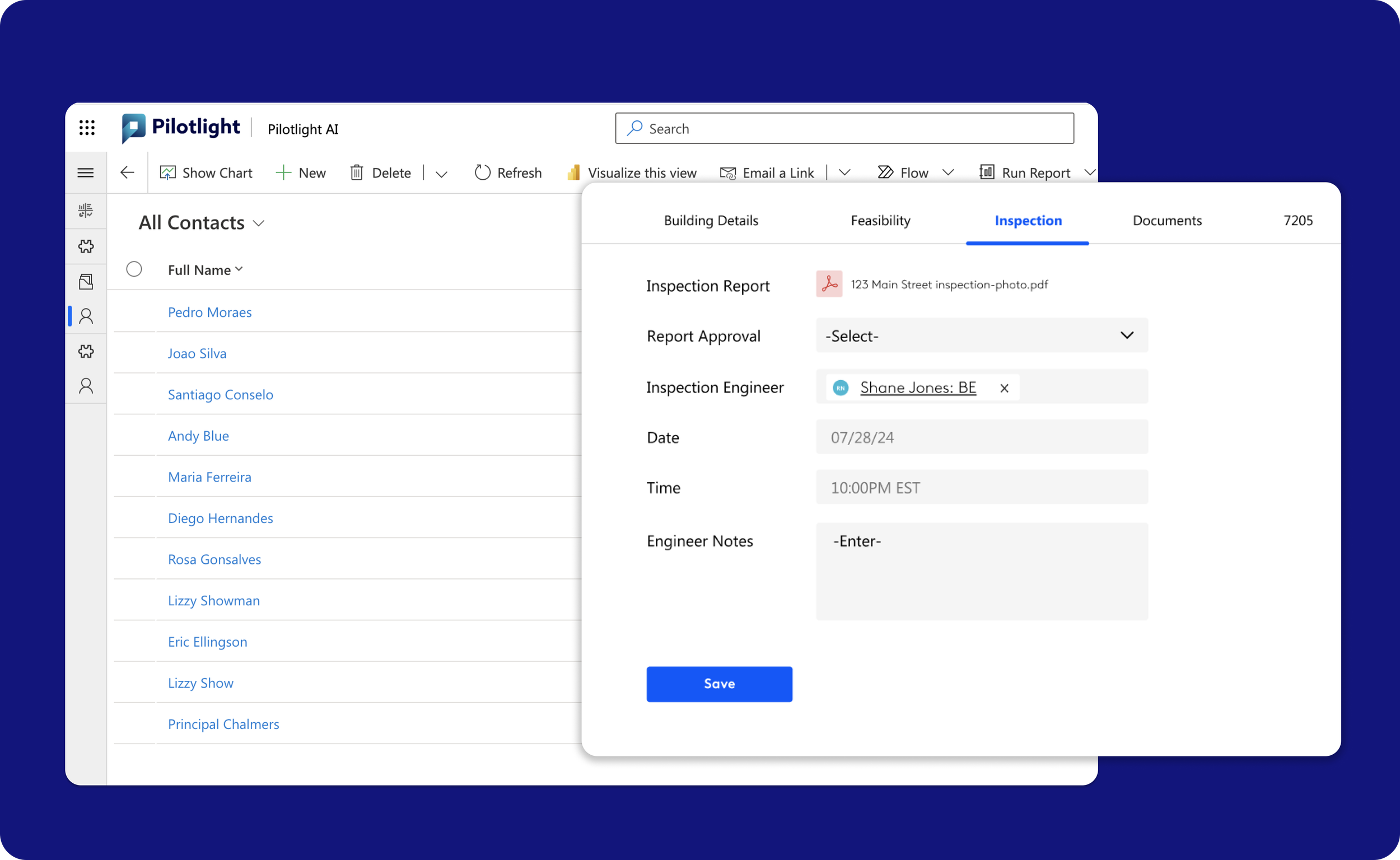

Automated workflow

Pilotlight automates the workflow process for filing the Investment Tax Credit (ITC), a federal tax incentive encouraging the installation of renewable energy systems. By streamlining each step, from project commencement to installation and documentation, Pilotlight ensures compliance with ITC criteria.

Team communication platform

To qualify, eligible properties must satisfy the installation and operation requirements (i.e. system can generate power) for solar photovoltaic (PV), solar water heating systems, fuel cells, small wind turbines, and geothermal systems. When these conditions are met, the ITC allows a credit for a percentage of the qualified expenditures— and as of 2023, solar energy systems qualify for 30% reimbursement of the installation cost and other expenditures which include costs directly associated with the system, such as equipment and labor for installation.

What is Investment Tax Credit?

The Investment Tax Credit (ITC) is a federal tax incentive designed to encourage the installation of renewable energy systems, particularly solar energy systems, in the United States. Commercial and tax-exempt buildings can qualify for the ITC by installing eligible renewable energy systems, such as solar PV systems, and meet specific criteria related to the project’s commencement, installation, ownership, and documentation.

-

The Investment Tax Credit (ITC) is a federal tax incentive that allows businesses to deduct a percentage of the cost of installing renewable energy systems, such as solar or wind, from their federal taxes.

-

Businesses and individuals who invest in qualifying renewable energy systems, including solar, wind, geothermal, and fuel cells, are eligible for the ITC.

-

The ITC allows you to deduct 26% of the cost of installing a renewable energy system from your federal taxes. This percentage is subject to change, so it's important to check current rates.

-

Qualifying systems include solar photovoltaic (PV), solar water heating, wind turbines, geothermal heat pumps, and fuel cell systems.

-

Yes, if the tax credit exceeds your tax liability, the unused portion can typically be carried forward to future tax years. Some provisions may also allow for it to be carried back to prior tax years.

-

Yes, the ITC can often be combined with other federal, state, and local incentives to further reduce the cost of renewable energy installations.

Other Pilotlight Solutions

Cost Segregation

Pilotlight's cost segregation intuitive interface and robust data management features, it enhances accuracy and efficiency, making cost segregation studies faster and more effective.

179D

Pilotlight's 179D solution simplifies the process of claiming energy-efficient commercial building tax deductions by automating eligibility assessment and documentation.

Prevailing Wage and Apprenticeship

This tool streamlines documentation and compliance processes in accordance to the Davis-Bacon Act, helping contractors and subcontractors maximize their 179D tax credits efficiently.